child care tax credit portal

You can no longer view or manage your advance Child Tax Credit Payments sent to you in 2021. Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today.

Tax Refunds Stimulus Payments Child Credits Could Complicate Filings

Last year the tax credit was also fully refundable meaning that if the credit amount a taxpayer qualified for exceeded.

. E-File Directly to the IRS. Connecticut State Department of Revenue Services. - Click here for updated information.

The child tax rebate which was recently authorized by the Connecticut General Assembly and signed into law by Governor Ned Lamont is intended to help Connecticut families with children. Ad Access IRS Tax Forms. 2021 Tax Filing Information Get your advance payments total and number of qualifying children in your online account and in the Letter 6419 we mailed you.

In 2021 the enhanced child tax credit meant that taxpayers with children ages 6 to 17 could get a credit of up to 3000. We dont make judgments or prescribe specific policies. Over 50 Million Returns Filed 48 Star Rating Fast Refunds and User Friendly.

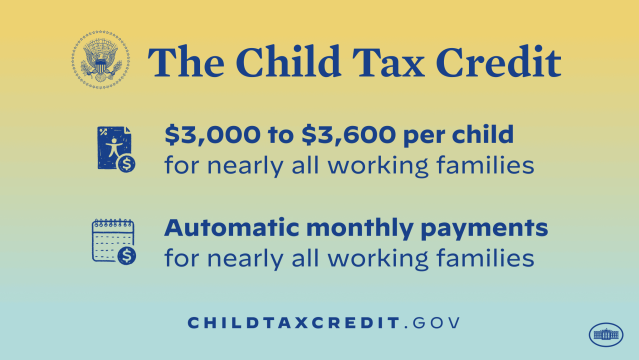

It also made the. Ad Tax Strategies that move you closer to your financial goals and objectives. The American Rescue Plan significantly increased the amount of Child Tax Credit a family could receive for 2021 typically from 2000 to 3000 or 3600 per qualifying child.

Ad Home of the Free Federal Tax Return. We provide guidance at critical junctures in your personal and professional life. You qualify for the full amount of the 2021 Child Tax Credit for each qualifying child if you meet all eligibility factors and your annual income is not more than.

If you received direct deposits to your bank account. See what makes us different. You may be eligible for a child tax rebate of up to a maximum of 750 250 per child up to.

The widget was created for low-income families those earning less than 12400 individually and 24800 for couples who arent required to file a. The Child Tax Credit provides money to support American families. The Child Tax Credit will help all families succeed.

Gas Tax - For updated information on the Suspension of the Motor Fuels Tax click here. Complete Edit or Print Tax Forms Instantly. Sales tax relief for sellers of meals.

CNMI Advance Child Tax Credit Update Portal. What is the Child Tax Credit. When you claim this credit when filing a tax return you can lower the taxes you owe and potentially increase your refund.

Must be working full time 30 hours or more a week attending school full time 12 credits or more or in job training at least 20 hours a week. Here is some important information to understand about this years Child Tax Credit. In the case of Feigh vCommissioner 152 TC No.

Have been a US. For 2022 that amount reverted to 2000 per child dependent 16 and younger. You can use the IRS Child Tax Credit Update Portal to view your payment history and verify that a check has been mailed to you or that you have received direct deposits.

This section will help you identify Child Tax Credit payments you have received and tell the difference from other tax benefits. We would like to show you a description here but the site wont allow us. The American Rescue Plan increased the Child Tax Credit from 2000 per child to 3000 per child for children over the age of six and from.

Sales Tax Holiday - To learn more about this years Sales Tax Free Week click here. 15 the IRS was found to have effectively created an unintended double tax benefit for receipt of a Medicaid waiver payment for care of a taxpayers adult disabled childrenThe Court found that the plain language of IRC 131 did not support the conclusion the IRS arrived at in Notice 2014-7 which treated such a. The Advance Child Tax Credit Update Portal is now closed.

Department of Revenue Services. 150000 if you are married and filing a joint return or if you are filing as a qualifying widow or widower. For the 2021 tax year.

In 2021 almost every family will be eligible for an additional Child Tax Credit to help families recover from the pandemic and support our youngest Texans. The Child Tax Credit CTC provides financial support to families to help raise their children. Ad Non-partisan not-for-profit resource for US data statistics on a variety of topics.

For children under 6 the amount jumped to 3600. For most families it will mean an extra 300 a month for each child under age six and 250 a month for those under age 17 including new babies. The Child Care Assistance Program can help lower-income families who are working in training or in school or a combination of these activities to pay a portion of their child care.

The Child Tax Credit Update Portal is no longer available.

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

/cdn.vox-cdn.com/uploads/chorus_asset/file/22675293/AP21172645952240.jpg)

Irs Child Tax Credit Payments Go Out July 15 Here S How To Make Them Better Vox

Childctc The Child Tax Credit The White House

The Child Tax Credit Toolkit The White House

Irs Sends Millions Letters About The Monthly Child Tax Credit Payments Forbes Advisor

Irs Glitch Halted Child Tax Credit Payments For Families With An Immigrant Spouse Cbs News

Child Tax Credit How To Get Your Money If You Lost The Irs Letter Cnet

Child Tax Credit Payments Will Start In July The New York Times

Child Tax Credit Schedule 8812 H R Block

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

As Child Tax Credit Payments Begin Biden Prepares To Speak The New York Times

Child Tax Credit Will There Be Another Check In April 2022 Marca

Parents Guide To The Child Tax Credit Nextadvisor With Time

The Child Tax Credit Toolkit The White House

Child Tax Credit Ending Will Push 10 Million Kids Back Into Poverty

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

Advance Child Tax Credit Payments Turbotax Support Video Youtube

Did Your Advance Child Tax Credit Payment End Or Change Tas

Irs Announced Monthly Child Tax Credit Payments To Start July 15 Forbes Advisor